Property No.3 🎉🎉 - What do we look for?

- Chris Moss

- Jun 26, 2021

- 3 min read

Updated: Nov 17, 2022

While my day job is helping entrepreneurs raise their profile online at Oversubscribed.co.uk, I have recently started to invest in single lets. My aim in blogging about my investments is simply to try help anyone who is thinking about investing to avoid the mistakes I am making and give an honest insight into the process/finances.

If this article is of interest, you might also like:

Before I jump into this blog - I want to thank the team at Oversubscribed for helping me pull these blogs together and support with my social content creation. If you are interested in raising your profile online, head over to Oversubscribed.

What do we look for?

Our first, second and third properties all look very different. However they do all have elements in common. Here are some of the criteria we look for:

Good family areas with high rental demand

Ideally a garden and parking

Ideally has curb appeal (would I want to live there)

Good transport links and access to big employment hubs

A property that needs some TLC (so we can add value)

10%+ ROCE (numbers explained in more detail here)

Cashflow £200+ pm (ideally closer to £250)

Potential for capital growth long term.

These are some of the high-level criteria we analyse when looking at a potential property. Some are more important than others with us making exceptions if the property meets the majority of them.

Why do we invest in property?

Unlike the index funds and single stocks we own, property gives a monthly cashflow which is appealing to us currently. I've gone into a lot more detail about our overall strategy here.

Some of the other benefits to this include:

- Increase in capital as house prices increase (hopefully)

- Very tangible and gives more control of the outcomes

- Able to use leverage (comes with risks though)

- Able to add value and increase your return on investment

Property investment No.3

We have not long completed on our third property where we are following a similar strategy to our first. In the first blog, I go into more detail on the strategy. Over the next 8-10 weeks we will be renovating the property, before renting it out.

This property was purchased at auction which comes with its extra challenges and an auction fee of £6,000 that needed to be taken into account. I will go into more detail about purchasing at auction in a future blog.

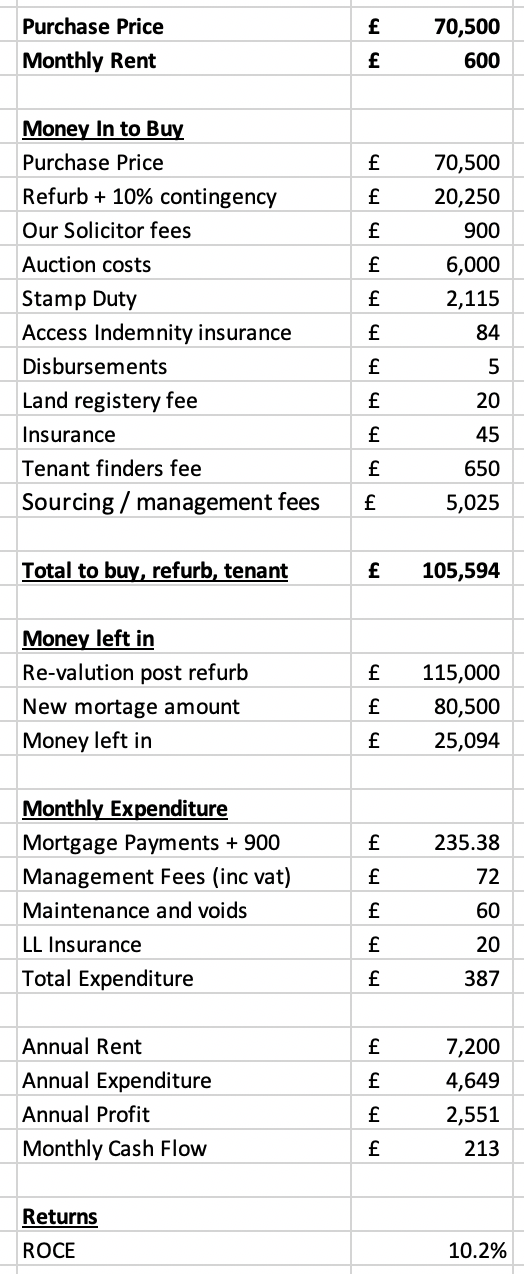

The numbers in theory

Purchase condition photos

Head over to our property Instagram to see what work will be carried out.

Rip out photos

Head over to our property Instagram to see what is being carried out next.

Following the refurb - ready to be rented:

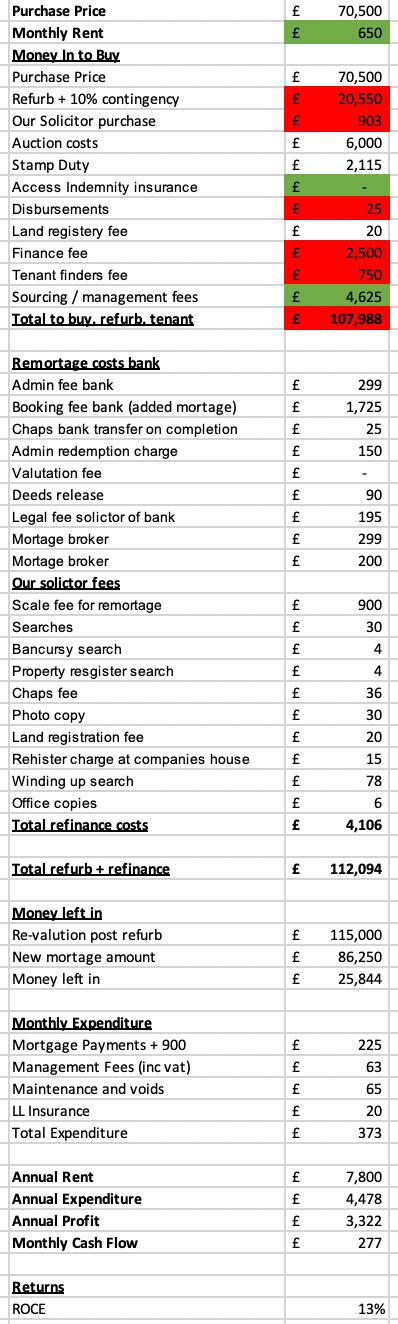

FINAL NUMBERS after being rented:

Originally the plan and numbers (as per above) were based on the house being rented for £600 pcm. However when the agent came to list it, it was apparent that a higher rent was achievable. They put it on the market for £650 pcm and rented it within a week. A good nice surprise but a sign of the current market conditions.

The costs no one tells you about.

The reason I wanted to start blogging about my investment properties was to help others not make the mistakes I make. I did a lot of research before I started but no one highlighted many of the costs I've listed on our excel below. These are different for every property, but don't forget to take into account:

- All the refinance costs from the bank (if you are putting a mortgage on the property).

- All the refinance costs from your solicitor (these are different to the solicitor purchase fees).

- Refurb costs running over budget.

Check out all the re-finance costs from the bank and solicitor... £30 for photo copies....mind blowing.

What went right ...

Rented out for £50pcm than expected

Return on capital was 2.8% higher than expected

Mortgage rate 3.1% (rather than 3.5%)

Monthly expected cashflow £277 (rather than £213)

What went wrong ...

Refurb £250 more than expected (not complaining about that)

Refinance costs higher than expected

If this blog post doesn't make sense, have a read of my first property investment that breaks down the strategy we are taking.

I hope this was useful and welcome any feedback. To learn more about me, check out my about page here. To see my latest project follow me on my social channels Instagram, LinkedIn, Facebook.

More articles you might like:

" About Chris "

" Home Page "

Comments